United States: AGA presents Commercial Gaming Revenue Tracker

Tuesday 18 de March 2025 / 12:00

2 minutos de lectura

(Washington D.C.).- AGA’s Commercial Gaming Revenue Tracker provides state-by-state and national insight into the U.S. commercial gaming industry’s financial performance based on state revenue reports. This issue highlights results for January 2025.

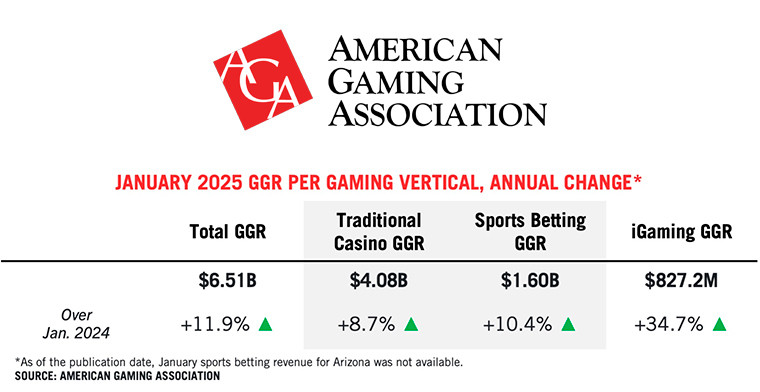

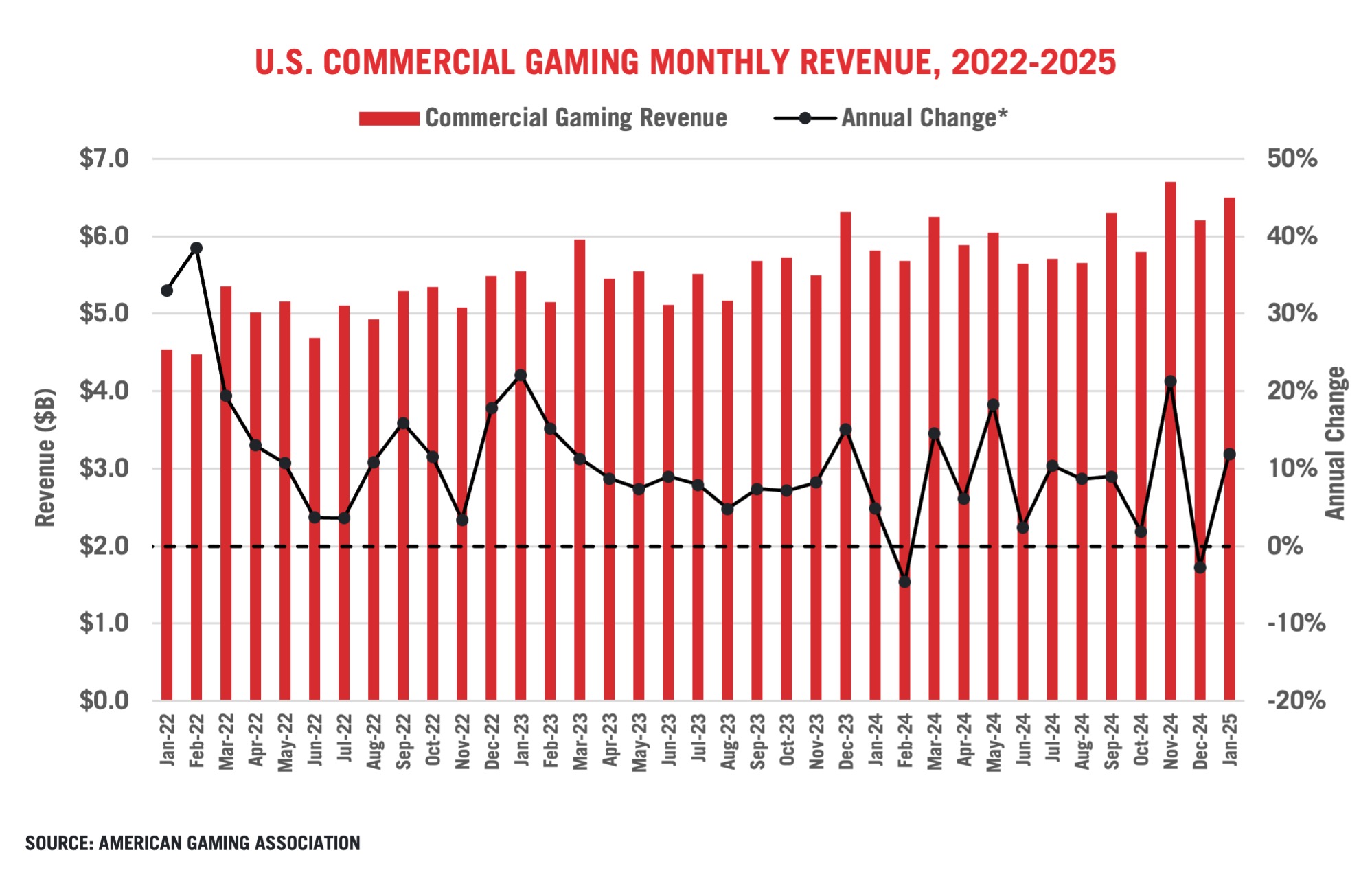

U.S. commercial gaming revenue expanded in January by 11.9 percent compared to the previous year. Combined revenue from traditional casino games, sports betting and iGaming reached $6.51 billion, a new January revenue record.

While iGaming continued its very strong growth and sports betting continued to perform strongly in January, brick-and-mortar gaming revenue grew by the fastest rate since January of 2023.

In total, 31 of 36 commercial gaming jurisdictions that were operational a year ago and had published full January data at the time of writing, saw expanded combined revenue from traditional casino games, sports betting and iGaming expand from the previous year. Sports betting revenue was not yet available for Arizona.

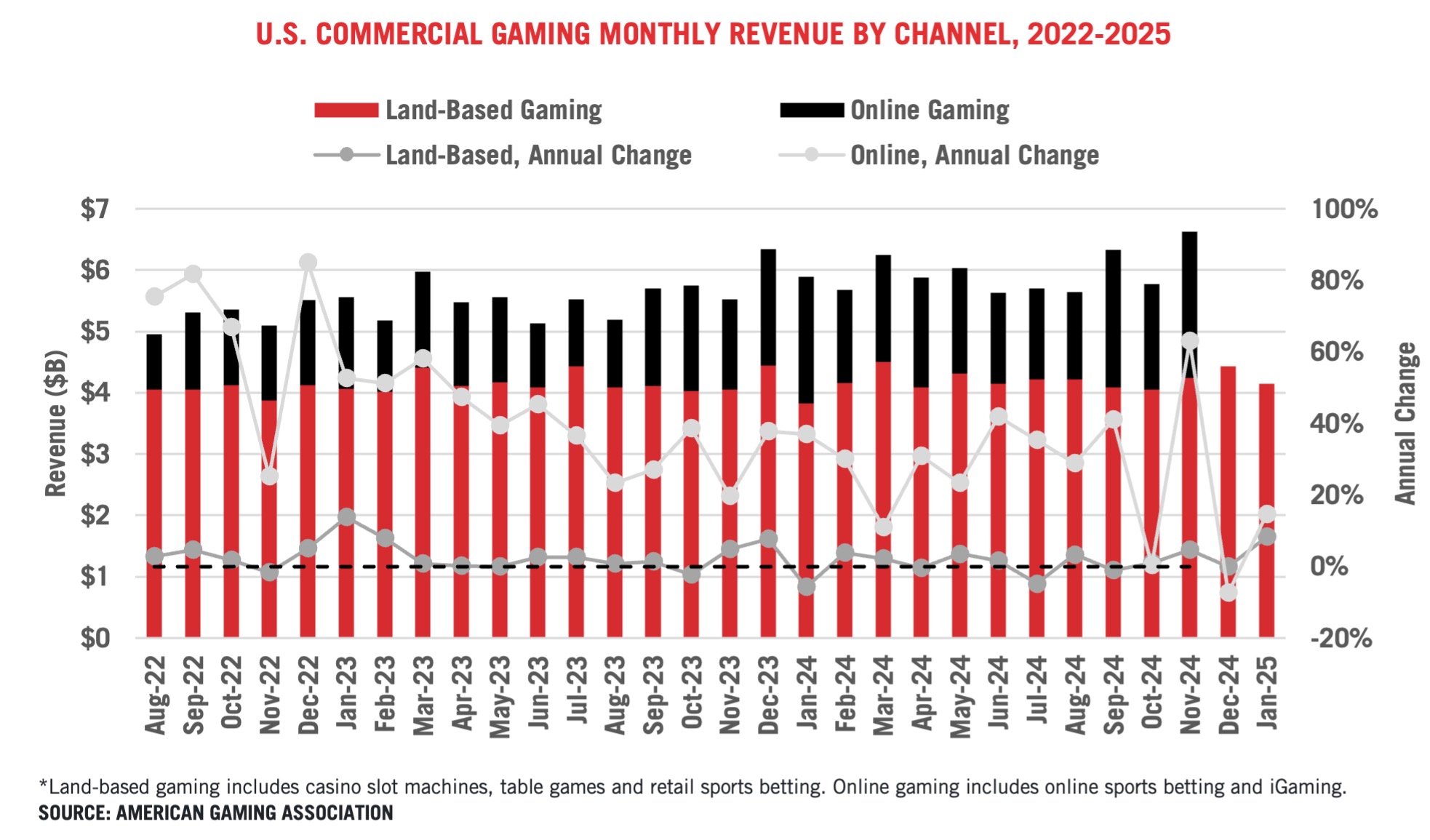

January revenue from land-based gaming—encompassing casino slots, table games and retail sports betting— totaled $4.15 billion, an 8.3 percent increase compared to the previous year.

Conversely, online gaming, which encompasses both online sports betting and iGaming, reported revenue of $2.36 billion nationwide, a 14.6 percent increase year-over-year. Online gaming makes up 36.3% of the total market in January, up Slightly from 35 percent in 2024.

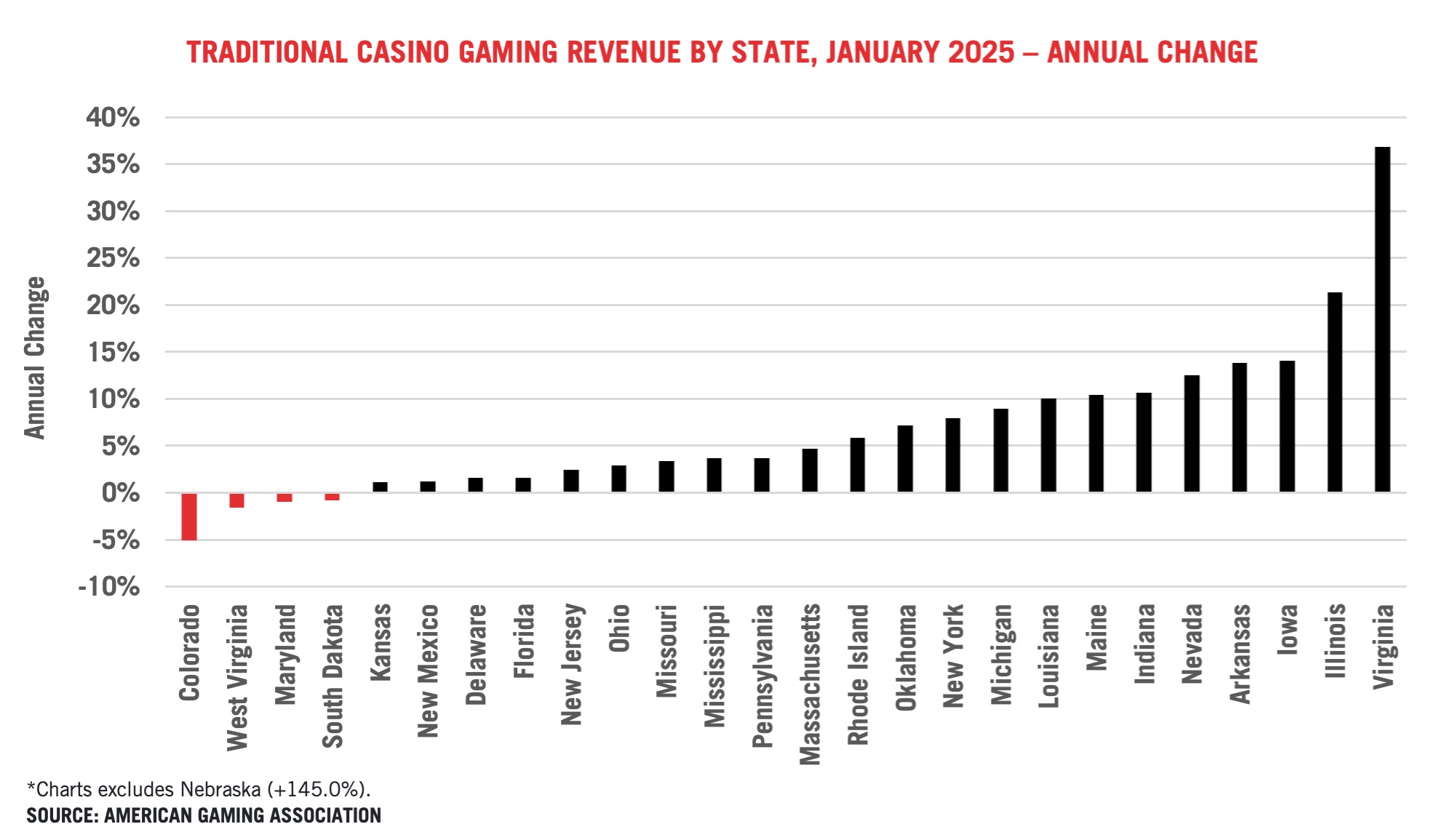

In January, traditional casino slot machines and table games collectively generated revenue of $4.08 billion, a year-over-year increase of 8.7 percent. Breaking that down further: slot machines generated $2.88 billion, up 6.1 percent, and table game revenue increased for the first time in seven months, expanding by 17.7 percent to $909.8 million. Nebraska, Virgina and Nevada particularly benefited from new property openings and a strong month on the Las Vegas Strip.

At the state level, 23 out of the 27 states offering traditional casino slot machines and/or table games posted a year-over-year revenue expansion in January with an average increase of 14.4 percent. Among the four states with declining January revenue – Colorado, Maryland, South Dakota and West Virginia –the average contraction was only 2.1 percent.

Note that the individual slot and table game figures exclude data from Louisiana and Michigan due to disparities in state reporting methodologies; however, their combined figures contribute to the nationwide total.

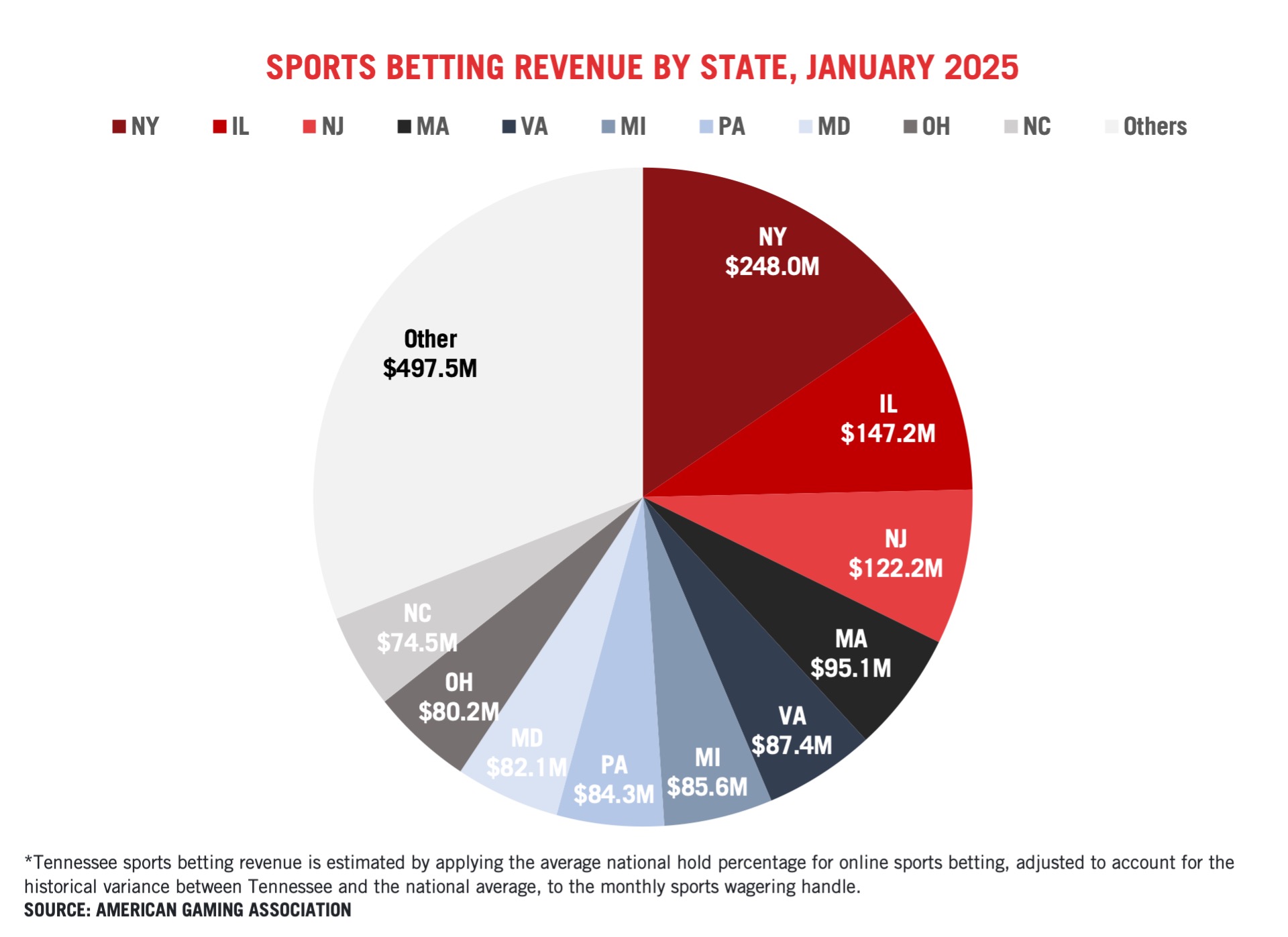

In January, nationwide sports betting revenue expanded by 10.4 percent year-over-year to reach $1.60 billion in revenue. While overall sports betting revenue increased, retail sports betting contracted by 8.8 percent.

Perhaps benefiting from a Lions playoff appearance, Michigan set an all-time sports betting revenue record in the month of January, increasing 77.5 percent to bringing $85.6 million. Montana also experienced a noteworthy year-over-year increase in sports betting revenue, up 51.3 percent with a hold rate of 22.4%, 7.9 points higher than January of last year. Conversely Ohio, New Jersey and Vermont all experienced year-over-year decreases over twenty percent.

January sports betting figures exclude data from Arizona as it had not been reported at the time of publication.

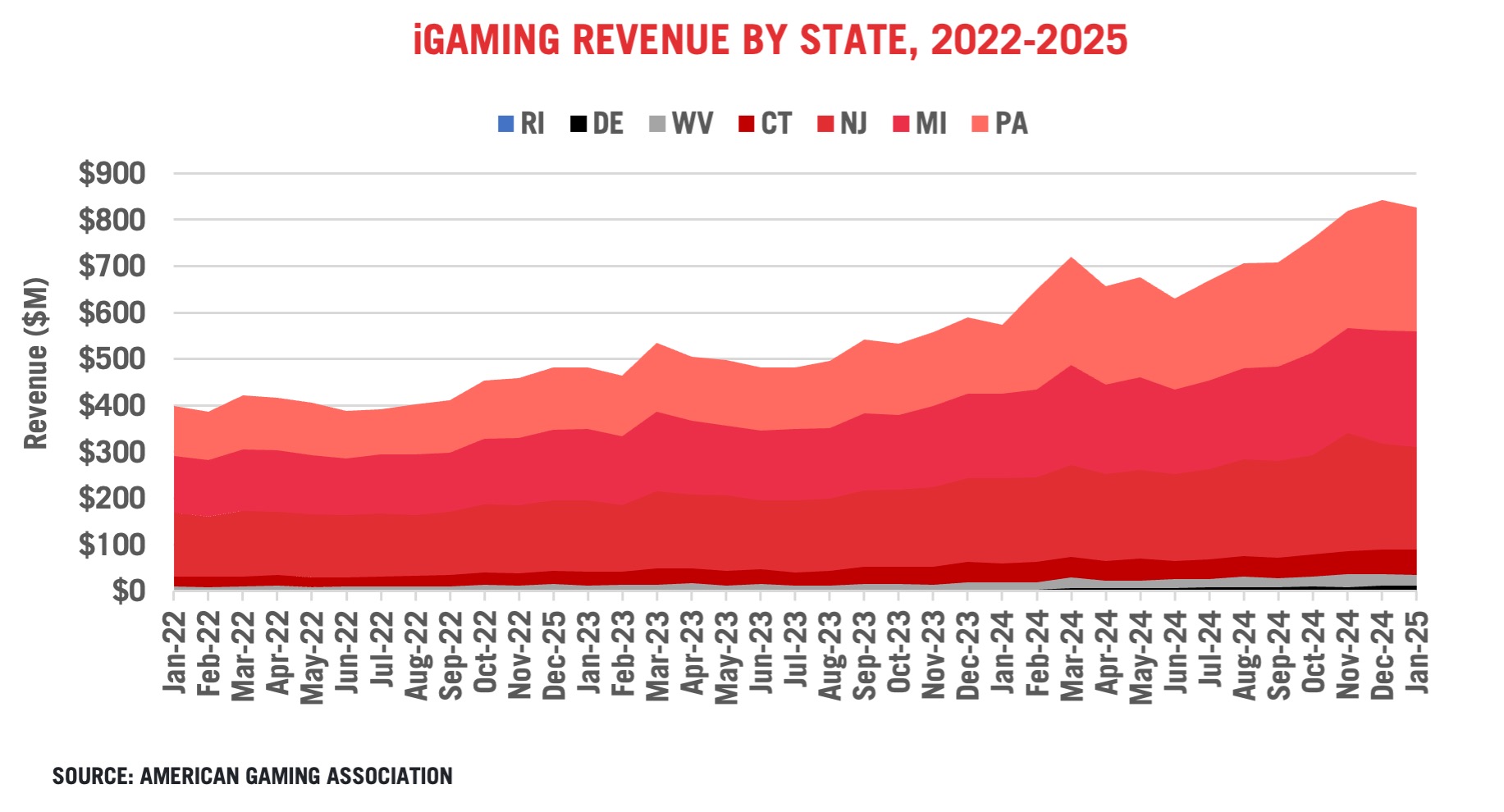

In January, combined revenue generated by the six operational iGaming markets increased 34.7 percent year-over-year, reaching $827.2 million. This represented the second-highest grossing month ever for iGaming revenue, trailing only December 2024’s $842.9 million.

All iGaming markets saw gains compared to the previous year, and Pennsylvania maintained its position as the largest iGaming market with 268.0M in revenue for January. Delaware posted a 162.2 percent increase over the same time last year, continuing to benefit from its mid- year shift in online betting vendors. Rhode Island begins its first full year with a legal iGaming market with$3.2 million in revenue for January.

Categoría:Reports & Data

Tags: Sin tags

País: United States

Región: North America

Event

SiGMA Central Europe 2025 Closes First Edition with High Attendance and Roman-Inspired Experiences

(Rome, Exclusive SoloAzar) - The first edition of SiGMA Central Europe in Rome came to a close, leaving a strong impression on the iGaming industry. With thousands of attendees, six pavilions brimming with innovation, and an atmosphere that paid homage to Roman history, the event combined spectacle, networking, and business opportunities. It also yielded key lessons for future editions.

Friday 07 Nov 2025 / 12:00

Innovation, Investment, and AI Take Center Stage on Day 3 of SiGMA Central Europe

(Rome, SoloAzar Exclusive).- November 6 marks the final and most dynamic day of SiGMA Central Europe 2025, with a packed agenda that blends cutting-edge tech, startup energy, and investor engagement. With exhibitions, conferences, and networking opportunities running throughout the day, Day 3 promises to close the event on a high note.

Thursday 06 Nov 2025 / 12:00

SiGMA Central Europe Awards 2025: BetConstruct Wins Innovative Sportsbook Solution of the Year

(Malta).- BetConstruct has been recognised at the SiGMA Central Europe Awards 2025, receiving the Innovative Sportsbook Solution of the Year award. This achievement highlights the company’s continued focus on elevating retail betting experiences and supporting operators with solutions that create measurable business value.

Wednesday 05 Nov 2025 / 12:00

SUSCRIBIRSE

Para suscribirse a nuestro newsletter, complete sus datos

Reciba todo el contenido más reciente en su correo electrónico varias veces al mes.